Indeed, for small businesses and entrepreneurs looking to manage their accounting and to track invoices, it can be difficult to pick the right tech solution. Forgetting to send an invoice due to poor record-keeping is an awful mistake for a business to make; not getting paid, especially when starting out, is simply not an option.

Affiliate Disclosure: Please note that this post contains affiliate links. Should you use one of the links on this page, we will receive a small commission if you purchase a FreshBooks membership. Thank you.

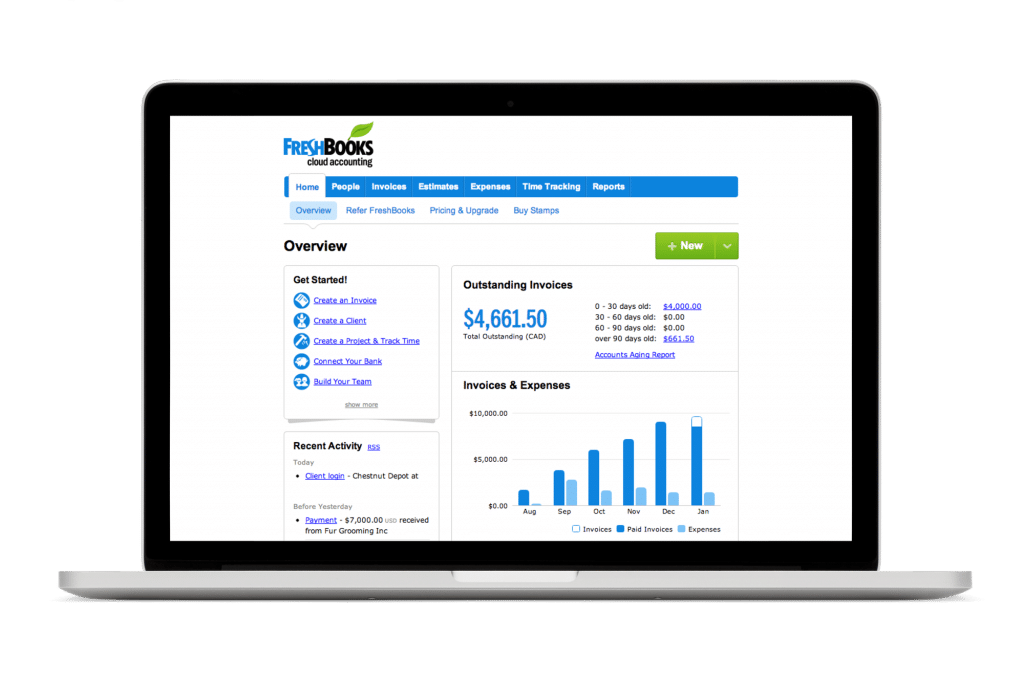

Many companies have worked to come up with solutions to this problem, and one noteworthy example is FreshBooks. They position themselves as cloud-based accounting software, focused on time tracking, generating invoices, and tracking business expenses. FreshBooks also has other useful features, including generating financial reports and syncing with other software.

FreshBooks Key Features or Why You Should Use FreshBooks for your Business

There are a few key advantages to using FreshBooks, all of which tie into their mantra “Stop wasting time to get paid.” The main purpose of the service is tracking your expenses and sending invoices to clients to get paid for your work. For the busy small business or one-man-army freelancer, this can be incredibly useful.

Syncing

Additionally, FreshBooks can be synced with a bank account to automatically track expenses. This is a much easier method than scavenging through folders full of receipts. The service is entirely cloud-based, which means that you’re not tied down to a specific computer or operating system. However, this also means that you need an internet connection to use the software. In the days of free WiFi and mobile hotspots, this likely won’t pose too big of a burden.

Client and Time Tracking

FreshBooks also allows users to save and store client information, and track the time that employees spend working on each project. This can help inform business decisions and make your business more efficient. Notice that you’re pouring too much time into a low-budget project? Maybe it’s time to cut that one loose or rethink the price.

Lower Transaction Fees

Another way that FreshBooks can help support your bottom line: drastically lower invoice fees than using methods like PayPal. The normal cost to use PayPal as an invoice system is roughly 3% of the transaction, which can definitely add up for the busy freelancer. In comparison, FreshBooks offers to send invoices and only charge $.50 per transaction, and these savings could add up to hundreds of dollars a month. At the very least, these savings would offset the subscription price for the software.

About FreshBooks Retainers

Keeping better track of recurring payments from a core set of customers is made easier in FreshBooks by the Retainers feature. A retainer in FreshBooks is similar to the retainer common to legal practices. The main difference is that it is a software feature in FreshBooks rather than a billing principal.

The feature allows you to apply a retainer payment to a customer’s account. You can then use FreshBooks to track the time you spend working for that client. You can program the system to warn you when you have exceeded the retainer’s hours, and even send a new invoice automatically.

FreshBooks’ Retainers feature makes it extremely easy to keep track of recurring payments without having to jump through hoops. The feature makes it easier to project future income, automatically send recurring invoices, effectively manage project progress, and track hours against time allotted to a particular client or project.

About Double-Entry Accounting

The fact that you are considering FreshBooks does not necessarily indicate you have used double-entry accounting before. So let us talk about that. Whenever you enter something into your accounting software, you are making an entry. Accountants work with both single and double entry.

Single-entry accounting creates a single entry for every transaction. Likewise, double-entry accounting involves two entries. One entry is a credit, the other is a debit.

A double-entry system should be easy to understand if you have a business credit card. When you pay your credit card via electronic transfer from your bank account, you are conducting a single transaction that shows up in two places. A debit entry appears in your bank account while a credit entry appears in the credit card account. Note that the two entries balance each other out.

FreshBooks Double-Entry Features

Before you upgrade to double-entry, you might want to know what features it offers. Here is a feature overview adapted from the FreshBooks website:

- The ability to relate the cost of goods sold to the cost of selling them.

- The ability to track income from operations not normally invoiced within FreshBooks.

- The ability to add more entries for transactions normally outside of FreshBooks, for the purposes of bank reconciliation.

- A general ledger that provides a full record of all the transactions throughout the life of the business.

- The ability to generate a trial balance statement for the purposes of verifying that debits and credits balance.

- A comprehensive account list with built-in charting for organization and categorizing.

- Personalized access for accountants who need real-time data to do what they do.

- The ability to generate a balance sheet including all assets, liabilities, and equity.

Double-Entry Is an Option

FreshBooks‘s double-entry system is an option, not a requirement. Any business that has gotten along fine with single-entry to his point can continue as-is. FreshBooks doesn’t require any customers to upgrade. Having said that, double-entry accounting is a useful tool for a lot of companies.

There is a lot to love about FreshBooks just as an accounting platform. There is more to love now that the platform offers double-entry accounting. Double-entry gives businesses a more detailed picture of their financial resources. Each entry represents both a benefit and a cost to the business. As such, it makes it easier to understand the value of a company in detailed terms.

FreshBooks Price

FreshBooks offers a variety of subscriptions, ranging from $10-40 a month. The basic subscription only allows users to save five clients, which your business might find limiting. The premium package of $40/month is definitely worth the time and money savings for a heavy user.

When it comes to using FreshBooks for your online accounting, there are only a few drawbacks we can think of: notably, FreshBooks doesn’t allow you to make quarterly tax payment estimates, so you’ll have to work that out by hand or use a different program. Additionally, there is the limitation of requiring an internet connection, but that’s a minor concern these days.

All in all, FreshBooks provides an exceptional value at a low price.

(416) 421-3178

(416) 421-3178